NEW YORK, NY — February 17, 2026 — PayCalculator.ai, a free FICA calculator and US state tax calculator, was launched today to provide workers with a breakdown of paycheck deductions. The online paycheck calculator tool can now be found at paycalculator.ai, using the current 2026 tax rates to generate estimated calculations of the federal income tax withholding, Social Security contributions, and Medicare taxes, as well as state-specific income tax deductions in all 50 states and Washington, D.C.

What is PayCalculator?

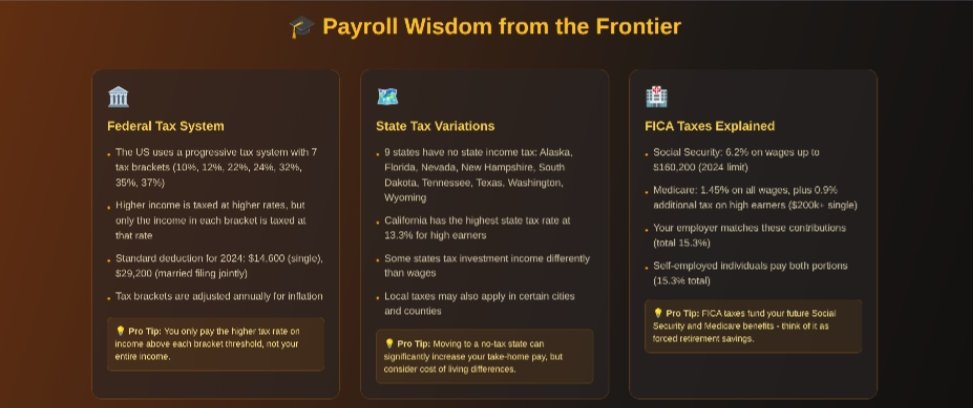

PayCalculator.ai is a free online pay calculator that divides gross pay into net pay, computing all mandated deductions using 2026 tax tables. The tool works both as a FICA calculator (which calculates a 6.2% Social Security tax (to the $184,500 wage base limit) and a 1.45% Medicare tax) and a full-fledged US state tax calculator that uses each state with its own income tax rates and brackets. Users input their gross salary, pay frequency, filing status, and state of residence to generate a paycheck breakdown.

How Does the Paycheck Calculator Work?

The platform uses follow-up state tax tables to pay with accuracy by integrating 2026 federal tax brackets (10%, 12%, 22%, 24%, 32%, 35%, and 37%). In the year 2026, a single individual will have a standard deduction of $16,100, and a married couple will have a standard deduction of $32,200. The FICA calculator uses the combined 7.65 employee contribution rate, with the Social Security tax limited to a maximum of $11,439 for high earners that reach the $184,500 wage base. The state tax calculator shows that the differences in the amount of state income taxes differ tremendously—the lowest amount is 0% in Texas and Florida, as well as in the seven other states, and the highest amount is 13% and above in California for those who earn a lot of money.

Why is Understanding Your Paycheck Important?

The PayCalculator.ai development team stated that understanding paycheck deductions can contribute to financial awareness. The tax withholding calculator allows employees to review W-4 selections, retirement contributions, and budgeting scenarios. Understanding how federal and state deductions affect take-home pay may assist users in evaluating personal financial planning options.

Key Features of the PayCalculator.ai Tool

The salary-to-hourly calculator facilitates various pay frequencies, such as weekly, biweekly, semi-monthly, and monthly computations. It features pre-tax reduction modeling on 401(k) contributions and health insurance premiums, calculation of overtime pay, and annual earnings. The program also computes the 0.9% Additional Medicare Tax on the amount of wages that exceed $200,000. The US state tax calculator encompasses the entire situation of the state income tax, such as states with progressive tax brackets, flat tax, and states with no income tax. Calculations are up to date based on 2026 IRS rules and can be performed instantly without any registration.

About PayCalculator.ai

PayCalculator.ai is a free online paycheck calculator system that is designed to provide users with visibility into income and tax calculations. The site is a combination of an easy-to-use FICA calculator and an all-in-one US state tax calculator to enable users to understand the withholding tax rate on federal income, Social Security taxes, Medicare contributions, the various state deductions, etc. PayCalculator.ai focuses on supporting access to tax calculation tools by providing updated financial calculators aligned with the current tax year.

Media Contact

Name: Jessie

Organization: Paycalculator

Website: paycalculator.ai

###